The EUR/USD pair finds itself under pressure as we head into a critical week for both the eurozone and US economies. Trading below the psychologically important 1.1700 level, the euro has retreated significantly from its September peak of 1.1920, with the US dollar gaining momentum from a combination of robust economic data and cautious Federal Reserve rhetoric.

Dollar Strength Drives EUR/USD Lower

The greenback’s recent resurgence can be attributed to several key factors that have shifted market sentiment in favor of the US currency. Fed Chair Jerome Powell’s emphasis on a balanced approach to rate cuts has resonated with investors, particularly his warnings about the risks of reigniting inflation through overly aggressive monetary easing.

While Powell’s comments didn’t immediately shake markets, the dollar found its footing mid-week as traders began reassessing the Fed’s likely pace of interest rate reductions. This reassessment was further validated by a series of impressive US economic indicators that underscored the resilience of the American economy.

The standout performer was the revised Q2 GDP figure, which surged to an impressive 3.8% year-over-year, exceeding initial estimates and reinforcing confidence in US economic fundamentals. Adding to this positive narrative, durable goods orders jumped 2.9% in August, while jobless claims fell by 14,000, painting a picture of robust economic activity and a healthy labor market.

Friday’s Core PCE inflation reading came in line with expectations at 2.9% year-over-year, providing no surprises but maintaining support for the Fed’s measured approach to policy adjustments.

Eurozone Shows Mixed Signals

The eurozone presents a more complex picture, with September PMI figures revealing divergent trends across sectors. While the manufacturing sector contracted, the services sector managed to post growth, resulting in a composite PMI reading of 51.2. This modest expansion, however, proved insufficient to provide meaningful support for the euro, particularly against the backdrop of broad-based dollar strength.

The mixed PMI data highlights ongoing challenges facing the eurozone economy, with manufacturing weakness continuing to weigh on overall growth prospects despite resilience in the services sector.

Key Events to Watch This Week

The coming week promises to be pivotal for EUR/USD direction, with several high-impact data releases scheduled across both regions:

Tuesday’s Focus:

- Germany Retail Sales

- HICP Inflation (year-over-year)

- Germany Unemployment

- Chicago PMI

- JOLTS Job Openings

Mid-Week Action:

- US ADP Employment Change (Wednesday)

- US Jobless Claims (Thursday)

Friday’s Main Event:

- US Non-Farm Payrolls (NFP)

The US labor market remains the primary focus for Federal Reserve policymakers, who have expressed concern about preventing further softening in employment conditions. Simultaneously, German economic data will be closely scrutinized as growth concerns across the eurozone continue to mount.

Central bank speeches throughout the week may provide additional market catalysts, potentially offering insights into future policy directions from both the Federal Reserve and European Central Bank.

Technical Outlook Suggests Further Weakness

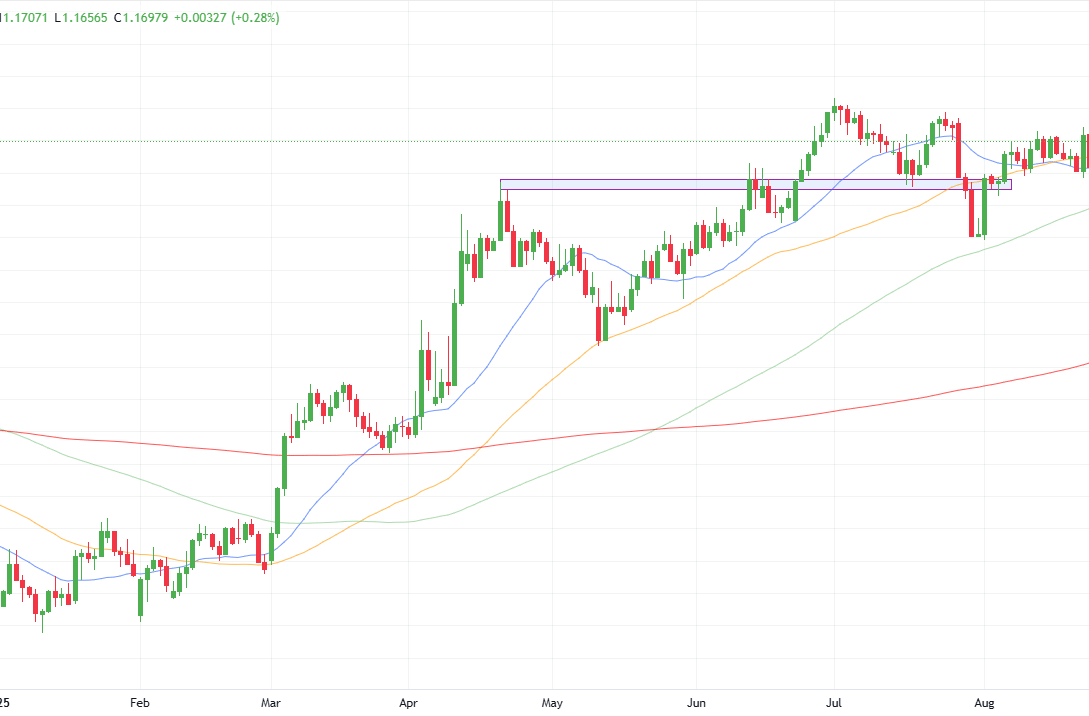

From a technical perspective, the EUR/USD daily chart reveals a concerning picture for euro bulls. The pair has broken below its rising channel and is now trading beneath the 20-day moving average. While there was a mild recovery from multi-week lows near the 50-day moving average, the euro remains vulnerable to further downside pressure.

The next significant support level emerges at the swing low and 100-day moving average near 1.1575. Should the pair fail to hold above the 50-day moving average on a sustained basis, it could trigger a more pronounced bearish trend, potentially targeting the July 31st lows around 1.1400, followed by the 200-day moving average and swing low near 1.1150.

However, should sentiment shift in favor of the euro, a break above 1.1700 could open the door to 1.1800, with potential for testing the yearly highs of 1.1920 and an ultimate target of 1.2000.

Week Ahead: Dollar Momentum vs. Euro Resilience

With the US dollar firmly in control and data risks appearing skewed toward continued US economic outperformance, EUR/USD faces an uphill battle to regain meaningful momentum in the near term. The euro’s trajectory this week will largely depend on whether inflation and employment data from both sides of the Atlantic can shift the prevailing policy narrative.

Given the current fundamental backdrop, traders should prepare for potential volatility around key data releases, particularly Friday’s NFP report, which could prove decisive in determining whether the dollar’s recent strength can be sustained or if the euro can mount a meaningful recovery from current levels.

The balance of risks appears tilted toward further euro weakness, but markets remain sensitive to any shifts in the economic data flow that could alter the Federal Reserve’s policy calculus or provide renewed optimism about eurozone growth prospects.