As European markets navigate through a period of cautious optimism, with the STOXX Europe 600 Index holding steady amid ongoing interest rate evaluations and trade uncertainties, investors are increasingly turning their attention to sectors that demonstrate both resilience and robust growth potential. In this dynamic environment, identifying high-growth technology stocks has become paramount, requiring a keen focus on companies that showcase strong innovation capabilities and the ability to adapt to shifting economic conditions.

The European Tech Growth Landscape

The European technology sector continues to produce companies that are not only surviving but thriving in challenging market conditions. The top performers in this space are characterized by impressive revenue and earnings growth metrics, with some companies achieving growth rates that significantly outpace their respective industries. These technology leaders span diverse subsectors, from gaming and healthcare software to communications technology, each bringing unique value propositions to the market.

Among the standout performers, companies like Intellego Technologies, argenx, and CD Projekt have demonstrated exceptional growth trajectories, with revenue growth rates ranging from 21% to over 35% and earnings growth reaching as high as 46%. However, three companies in particular merit closer examination for investors seeking exposure to Europe’s high-growth tech sector.

Paradox Interactive: Gaming Innovation Meets Community Engagement

Market Cap: SEK 18.48 billion

Growth Rating: ★★★★☆☆

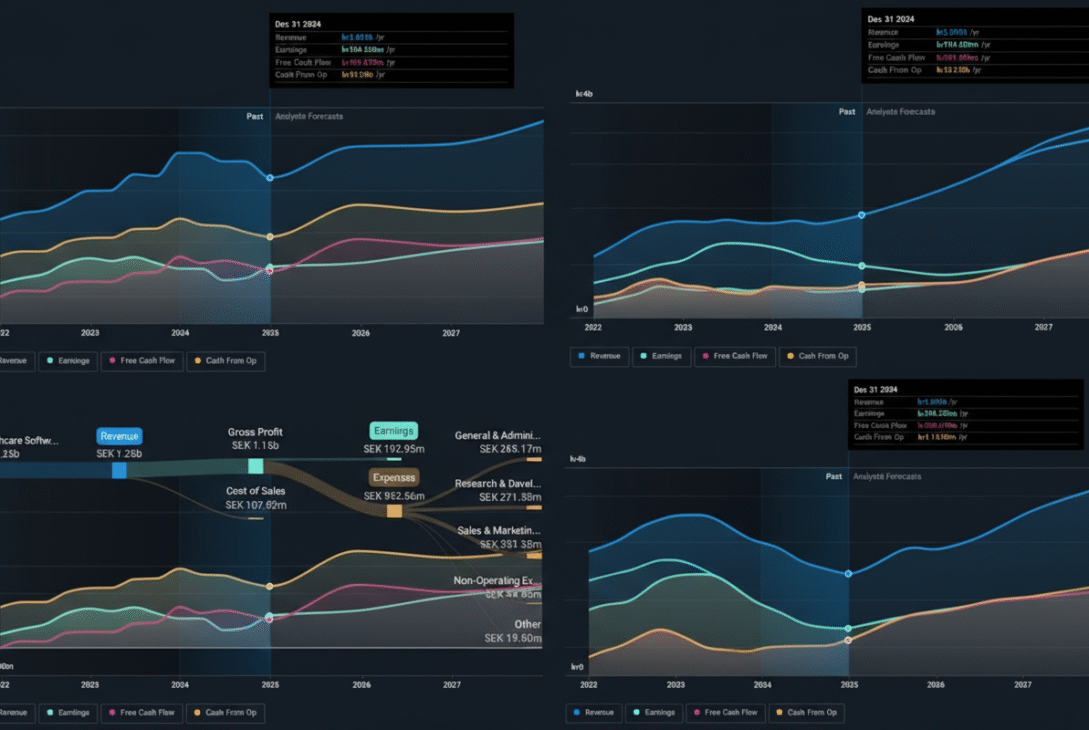

Paradox Interactive, the Swedish game developer and publisher specializing in strategy and management games, has emerged as a compelling growth story in the European tech landscape. The company’s operations span PC and console platforms, with a strong presence across the United States, Europe, and international markets, generating revenue of SEK 2.07 billion from its computer graphics segment.

What sets Paradox apart is its remarkable earnings trajectory. The company posted an extraordinary 106.5% increase in earnings over the past year, significantly outperforming the entertainment industry average of 49.9%. This impressive performance is underpinned by a strategic emphasis on research and development, which has yielded innovative releases such as “Shops of Shibuya” and “Map Pack 4” for Cities: Skylines.

Paradox’s approach to game development represents a forward-thinking model in the gaming sector. By embracing community-driven content and collaborative development strategies, the company has enhanced user engagement while simultaneously expanding its product portfolio. This methodology not only strengthens customer loyalty but also creates sustainable growth pathways through recurring content releases.

Looking ahead, Paradox is positioned for continued success with an expected annual earnings growth of 19.9%, outpacing the Swedish market forecast of 16.4%. This projection suggests that the company’s creative product strategies and market-responsive development approach will continue to drive profitability in the years ahead.

RaySearch Laboratories: Transforming Cancer Treatment Through Technology

Market Cap: SEK 8.64 billion

Growth Rating: ★★★★★☆

RaySearch Laboratories stands at the forefront of medical technology innovation, offering sophisticated software solutions designed to revolutionize cancer treatment worldwide. With revenue of SEK 1.25 billion generated through its healthcare software segment, the company represents a compelling investment opportunity in the intersection of healthcare and technology.

The company’s commitment to innovation was prominently displayed at ASTRO 2025, where RaySearch showcased significant advancements in oncology treatment solutions. The presentation featured cutting-edge capabilities in RayStation®, including high-speed adaptive replanning and AI-driven image segmentation, alongside demonstrations of RayCare® and RayIntelligence®. These technological breakthroughs underscore the company’s dedication to enhancing cancer care through continuous innovation.

RaySearch’s financial performance reflects the strength of its technology platform and market position. The company has achieved annual revenue growth of 13.7% coupled with impressive earnings growth of 24.8%, rates that exceed average industry benchmarks. This performance is supported by substantial investment in research and development, with R&D expenditures totaling SEK 150 million in the past year.

The company’s strategic focus on R&D is not merely a cost center but rather a critical investment in future growth. By continuously advancing its technological capabilities and forming strategic partnerships, RaySearch is positioning itself as a pivotal player in shaping the future of oncology treatments. As healthcare systems worldwide increasingly adopt advanced software solutions to improve patient outcomes, RaySearch appears well-positioned to capture growing market demand.

Truecaller: Leveraging Data Intelligence in Communications

Market Cap: SEK 14.23 billion

Growth Rating: ★★★★★☆

Truecaller has carved out a distinctive niche in the communications technology sector through its mobile caller ID applications, serving both individual consumers and business clients across India, the Middle East, Africa, and other international markets. The company’s communications software segment generates approximately SEK 2 billion in revenue, reflecting its strong market penetration.

Recent strategic moves signal Truecaller’s ambition to expand beyond its core offering. The appointment of Archana Roche to lead global measurement and analytics for the company’s Ad Solutions business represents a significant step in enhancing its advertising capabilities. This executive addition aligns with Truecaller’s broader strategy of leveraging data-driven insights to improve advertising efficacy, tapping into the industry-wide trend toward sophisticated digital marketing strategies.

The company’s financial performance in the first half of 2025 demonstrated solid momentum, with revenues reaching SEK 1.01 billion, marking an 18.8% year-over-year increase. While net income experienced a slight decrease to SEK 219.72 million from SEK 256.06 million in the previous year, this reduction reflects strategic investments aimed at expanding technological capabilities and market reach rather than operational weakness.

Truecaller’s proactive approach to market evolution positions it well for sustained growth. By investing in its advertising technology infrastructure and expanding its analytical capabilities, the company is adapting to changing market demands while maintaining its competitive edge in an increasingly crowded communications technology landscape.

Investment Considerations

These three companies represent different facets of Europe’s high-growth technology sector, each with distinct competitive advantages and growth drivers. Paradox Interactive demonstrates the power of community-driven content creation in gaming, RaySearch Laboratories showcases the potential of healthcare technology innovation, and Truecaller illustrates the value of data intelligence in communications.

For investors seeking exposure to European technology growth, these companies offer compelling narratives supported by strong financial performance, strategic innovation, and market-responsive business models. As the European market continues to navigate economic uncertainties, companies that demonstrate adaptability, strong R&D capabilities, and clear paths to sustained profitability are likely to emerge as long-term winners in the technology sector.

While past performance is not indicative of future results, the combination of robust earnings growth, strategic investments in innovation, and expanding market opportunities suggests these companies are well-positioned to continue their growth trajectories in the evolving European technology landscape.