Executive Summary

Wolverine World Wide (NYSE: WWW) has experienced significant share price volatility over the past year, with a remarkable 63% climb followed by recent pullbacks. This analysis examines the company’s current valuation amid these price swings, evaluating whether the stock presents a compelling investment opportunity or reflects overextended market expectations. Current analysis suggests the stock may be 17.2% undervalued with a fair value target of $33.67, though conflicting market signals warrant careful consideration.

Introduction

Wolverine World Wide, a prominent footwear company with brands including Saucony, Merrell, and others, has captured investor attention through substantial share price movements without corresponding high-profile announcements. The company’s stock performance reflects broader market dynamics while raising fundamental questions about valuation accuracy and growth sustainability. This paper analyzes the driving factors behind recent price action and evaluates competing valuation perspectives.

Recent Share Price Performance Analysis

Performance Metrics

The stock’s performance over different timeframes reveals a complex picture:

- 12-month performance: +63% overall gain

- 3-month performance: Particularly strong momentum

- 1-month performance: -12% decline

- Year-to-date: Mixed results with notable volatility

Performance Context

The strong quarterly momentum contrasts sharply with more subdued longer-term growth patterns, suggesting recent acceleration in investor sentiment or fundamental improvements. The 12% monthly decline indicates potential profit-taking or emerging concerns about sustainability of the growth trajectory.

Fundamental Performance Supporting Stock Movement

Revenue and Earnings Trends

Supporting the positive share price action, Wolverine World Wide has demonstrated:

- Rising revenue trends

- Improving net income performance

- Strengthened operational metrics

These fundamental improvements provide some justification for the stock’s appreciation, distinguishing it from purely speculative movements seen in some market segments.

Primary Valuation Narrative: 17.2% Undervalued

Fair Value Assessment

The prevailing analytical consensus suggests:

- Fair value target: $33.67 per share

- Current valuation gap: 17.2% undervalued

- Investment thesis: Strong growth momentum with earnings acceleration potential

Growth Drivers Analysis

Consumer Trend Alignment

Several macro trends support Wolverine’s positioning:

- Health and wellness focus: Increased consumer emphasis on active lifestyles

- Outdoor activity surge: Post-pandemic shift toward outdoor recreation

- Athletic footwear demand: Sustained growth in performance footwear categories

Product Innovation Strategy

The company’s innovation pipeline includes:

- Saucony Endorphin: High-performance running franchise

- Merrell Moab Speed 2: Outdoor hiking and trail running segment

- Core brand development: Continued investment in flagship product lines

Financial Projections

The undervaluation thesis rests on several key assumptions:

- Earnings acceleration: Projected double-digit earnings growth

- Margin expansion: Operational efficiency improvements

- Discount rate advantage: Favorable cost of capital relative to industry peers

Sustainable Competitive Advantages

Wolverine’s market position benefits from:

- Established brand recognition across multiple segments

- Distribution network strength

- Innovation capabilities in technical footwear

- Global market presence with expansion opportunities

Alternative Market Perspective: Overvaluation Concerns

Industry Comparison Analysis

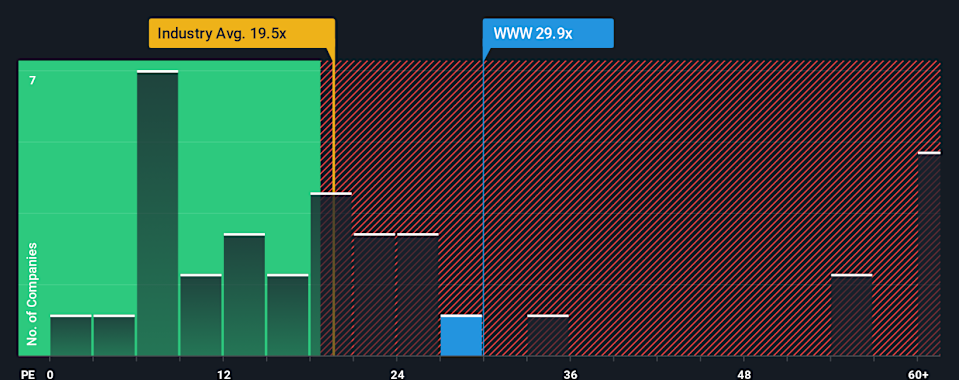

Market-based valuation metrics suggest potential overvaluation:

- Industry multiple comparison: Trading above sector averages

- Peer group analysis: Premium valuation relative to comparable companies

- Growth expectations: Potentially optimistic future projections already reflected in price

Risk Factors Challenging Growth Narrative

Channel Concentration Risk

- Wholesale dependence: Heavy reliance on wholesale distribution channels

- Retail partner risk: Vulnerability to major retailer performance and strategy changes

- Direct-to-consumer limitations: Underdeveloped direct sales capabilities

Macroeconomic Vulnerabilities

- Consumer spending sensitivity: Discretionary nature of footwear purchases

- Supply chain disruption: Ongoing global logistics challenges

- Inflationary pressures: Rising input costs and labor expenses

- Economic recession risk: Potential downturn impact on consumer demand

Valuation Methodology Analysis

Discounted Cash Flow Considerations

The fair value calculation likely incorporates:

- Revenue growth projections: Based on market expansion and share gains

- Margin improvement assumptions: Operational efficiency and pricing power

- Terminal value estimates: Long-term sustainable growth rates

- Discount rate selection: Risk-adjusted cost of capital

Multiple-Based Valuation

Alternative approaches may consider:

- Price-to-earnings ratios: Current and forward-looking multiples

- Enterprise value metrics: EV/EBITDA and EV/Sales comparisons

- Price-to-book ratios: Asset-based valuation perspectives

Investment Decision Framework

Bull Case Scenario

Positive factors supporting investment:

- Strong fundamental performance trajectory

- Favorable consumer trend alignment

- Product innovation success

- Global expansion opportunities

- Potential margin expansion

- Undervaluation relative to intrinsic worth

Bear Case Scenario

Risk factors arguing for caution:

- Wholesale channel concentration

- Macroeconomic headwinds

- Premium valuation relative to peers

- Recent momentum potentially overdone

- Supply chain vulnerabilities

- Consumer discretionary spending risks

Strategic Recommendations

For Growth-Oriented Investors

- Position sizing: Consider measured exposure given volatility

- Entry timing: Monitor for technical support levels

- Diversification: Ensure appropriate sector allocation limits

For Value-Focused Investors

- Fundamental analysis: Verify earnings quality and sustainability

- Margin of safety: Require additional discount given uncertainties

- Catalyst identification: Monitor for specific growth drivers

For Risk-Averse Investors

- Caution warranted: Recent volatility suggests elevated risk

- Alternative opportunities: Consider more stable value propositions

- Monitoring approach: Watch from sidelines until clearer trends emerge

Conclusion

Wolverine World Wide presents a complex investment case following significant share price swings. While fundamental analysis suggests potential undervaluation of 17.2%, conflicting market signals and substantial risk factors warrant careful consideration. The company benefits from favorable consumer trends and product innovation success, but faces challenges from wholesale channel dependence and macroeconomic uncertainties.

The investment decision ultimately depends on individual risk tolerance, investment timeframe, and conviction in the company’s ability to execute its growth strategy amid challenging operating conditions. Given the recent volatility and mixed signals, a measured approach with careful position sizing appears most prudent.

Investors should continue monitoring quarterly results, management guidance updates, and broader market conditions to refine their investment thesis. The stock’s recent performance suggests significant market interest, but sustainability of the growth narrative remains the critical question for long-term value creation.

This analysis is based on available market data and should be supplemented with additional research and professional investment advice before making investment decisions.