European Market Highlights: Promising Penny Stocks For October 2025

Executive Summary

As European markets navigate the complexities of evolving interest rate policies and shifting trade dynamics in October 2025, the pan-European STOXX Europe 600 Index maintains its equilibrium. Within this landscape, penny stocks continue to represent an intriguing investment category, offering exposure to smaller or less-established companies that may harbor significant value opportunities. This paper examines the current state of European penny stocks, with particular focus on three notable companies that demonstrate varying degrees of financial health and growth potential.

Market Context

The term “penny stocks” may carry historical connotations, but it remains relevant in capturing the essence of investment opportunities within the smaller capitalization segment of European markets. These securities often fly under the radar of mainstream institutional investors, creating potential inefficiencies that astute investors can exploit. The key to successful investing in this space lies in identifying companies with robust financial fundamentals and credible growth trajectories, rather than simply chasing low share prices.

Current market conditions present both opportunities and challenges for penny stock investors. Interest rate policies across Europe continue to influence investor sentiment and capital allocation decisions, while trade dynamics add another layer of complexity to the investment landscape. Against this backdrop, careful selection becomes paramount.

Top European Penny Stocks Overview

The current landscape features ten standout penny stocks across European exchanges, spanning multiple sectors and geographies. These range from established industrial players to emerging technology firms, with market capitalizations varying from approximately €16 million to over €1.4 billion. Financial health ratings provide a useful framework for evaluation, with several companies achieving the highest six-star rating, indicating strong balance sheets and operational metrics.

The diversity of this group is noteworthy, encompassing Swedish gaming companies, Finnish logistics providers, Italian media firms, and Belgian building materials manufacturers. This geographic and sectoral distribution offers investors multiple avenues for portfolio diversification within the penny stock category.

Featured Company Analysis

Deceuninck NV: A Turnaround Story in Building Materials

Financial Health Rating: ★★★★★★

Market Capitalization: €304.09 million

Share Price: €2.20

Deceuninck stands as a compelling example of operational recovery within the European penny stock universe. The Belgian company, which designs, manufactures, recycles, and distributes multi-material window, door, and building solutions across Europe, North America, Turkey, and international markets, has demonstrated remarkable financial improvement despite challenging top-line conditions.

The company’s recent earnings report reveals a striking turnaround narrative. Net income surged to €11.15 million for the first half of 2025, representing a substantial increase from €7.74 million in the comparable period of the previous year. This performance becomes even more impressive when considered against the backdrop of declining sales, which fell to €383.55 million from €421.57 million year-over-year. The ability to expand profitability while revenues contract speaks to meaningful operational improvements and cost management initiatives.

Deceuninck’s financial foundation appears solid across multiple dimensions. The company boasts impressive earnings growth of over 800% in the most recent fiscal year, though this figure likely reflects recovery from depressed prior-year levels rather than sustainable organic expansion. More importantly from a risk perspective, short-term assets exceed liabilities, and the company maintains adequate coverage of interest payments on its debt obligations, suggesting financial flexibility.

Revenue composition reveals a business concentrated in its core Window and Door Systems segment, which generates €724.41 million annually, supplemented by smaller Home Protection and Outdoor Living divisions contributing €38.30 million and €26.26 million respectively. This diversification provides some buffer against cyclical fluctuations in any single market segment.

However, investors should remain cognizant of certain limitations. The management team’s relative inexperience may pose execution risks as the company navigates its turnaround. Additionally, the return on equity stands at a modest 5.7%, indicating that the company is not yet generating compelling returns on shareholder capital. Perhaps most concerning for income-focused investors, Deceuninck exhibits an unstable dividend track record, suggesting that consistent cash returns to shareholders should not be expected in the near term.

Nurminen Logistics Oyj: Nordic Logistics with Strong Returns

Financial Health Rating: ★★★★★☆

Market Capitalization: €83.92 million

Share Price: €1.04

Nurminen Logistics represents an intriguing opportunity within the European transportation sector, offering logistics services across Finland, Russia, Sweden, and the Baltic countries. The company’s recent financial performance signals a positive inflection point that merits investor attention.

The Finnish logistics provider reported net income of €1.47 million for the second quarter of 2025, a dramatic improvement from the loss recorded in the prior-year period. Sales reached €27.93 million for the quarter, derived entirely from the company’s Transportation-Trucking segment, which generates annual revenue of €107.40 million. This narrow operational focus creates both concentration risk and the potential for operational excellence within a defined niche.

From a balance sheet perspective, Nurminen demonstrates satisfactory debt management characteristics. Operating cash flow covers 52.9% of outstanding debt, a reasonable coverage ratio that suggests the company could theoretically delever over approximately two years through operational cash generation alone. Interest coverage appears robust, with EBIT exceeding interest expenses by a factor of 4.7 times, providing comfortable cushion for debt servicing obligations.

The company’s return on equity stands at an impressive 33.2%, indicating that management is generating strong returns on the capital entrusted to them by shareholders. This metric substantially exceeds Deceuninck’s ROE and suggests effective capital allocation and operational efficiency. Furthermore, Nurminen’s shares trade significantly below estimated fair value, potentially offering an attractive entry point for value-oriented investors.

Despite these strengths, certain financial vulnerabilities warrant consideration. The company’s short-term assets do not fully cover its long-term liabilities, creating potential liquidity concerns should operating conditions deteriorate or debt refinancing become necessary. Additionally, the company has experienced negative earnings growth in recent periods prior to the current recovery, suggesting that the business may be cyclically sensitive or operationally volatile.

The geographic footprint spanning Finland, Russia, Sweden, and the Baltic states presents both opportunity and risk. While regional diversification provides multiple revenue streams, exposure to Russia introduces geopolitical and economic uncertainties that could impact operations unpredictably.

Acarix AB: High-Risk, High-Reward Medical Technology

Financial Health Rating: ★★★★☆☆

Market Capitalization: SEK 335.31 million (approximately €29 million)

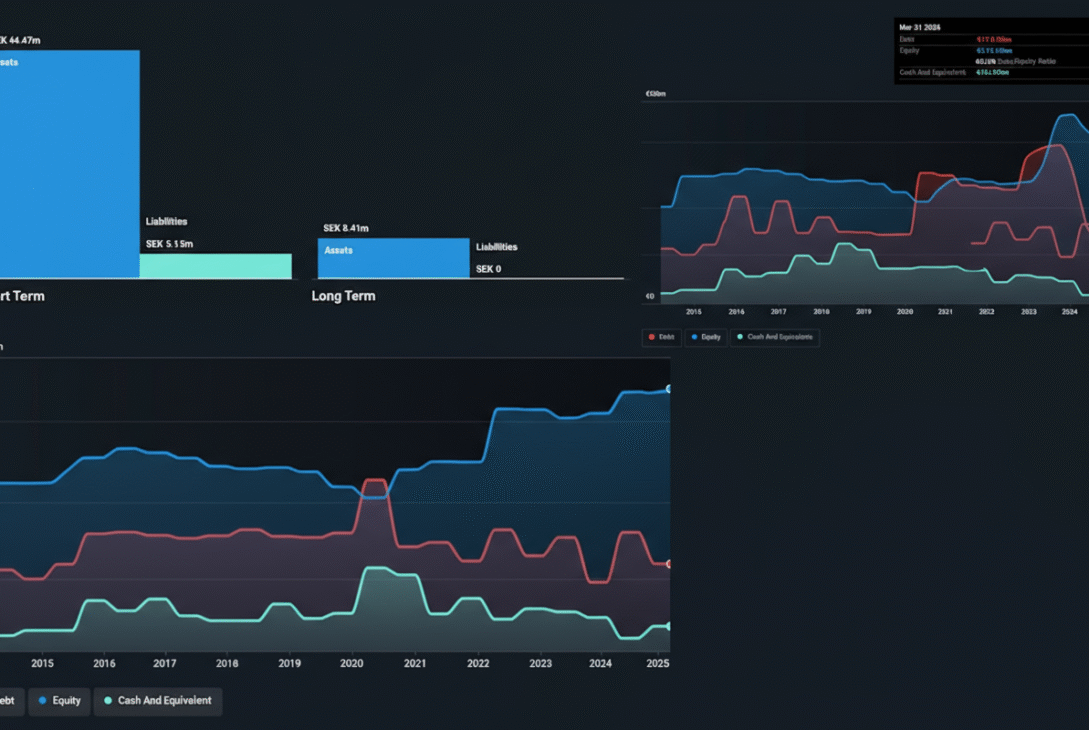

Acarix occupies a distinctly different position within the penny stock landscape, representing the high-risk, high-reward profile of pre-revenue medical device companies. The Swedish firm develops AI-based solutions for the rapid rule-out of coronary artery disease, positioning itself at the intersection of artificial intelligence and cardiovascular diagnostics.

The company’s financial profile reflects its early-stage nature. Acarix reported sales of only SEK 2.87 million for the first half of 2025, derived entirely from its Diagnostic Kits and Equipment segment, which generates annual revenue of just SEK 5.56 million. This minimal revenue generation, combined with ongoing operating losses, places Acarix firmly in the pre-commercial phase of its lifecycle.

Recent operational developments provide glimpses of potential future traction. The company has made progress on U.S. reimbursement processes for its CADScor device, a critical milestone for market adoption in the world’s largest healthcare market. Additionally, Acarix secured a SEK 1.35 million order for entry into the MENA (Middle East and North Africa) market, demonstrating geographic expansion and commercial validation of its technology.

From a financial risk perspective, Acarix presents a mixed picture. On the positive side, the company maintains a debt-free balance sheet and holds short-term assets exceeding short-term liabilities, providing some financial cushion. However, the company possesses less than one year of cash runway at current burn rates, creating urgency around either achieving revenue growth, securing additional financing, or implementing cost reductions.

The unprofitable nature of Acarix’s operations is expected for a pre-revenue medical device company but necessitates continued capital infusions until commercial scale is achieved. Management’s limited experience adds execution risk to an already speculative investment proposition. Furthermore, high share price volatility reflects market uncertainty about the company’s prospects and the binary nature of outcomes in the medical device sector.

Acarix represents a classic early-stage growth investment, suitable only for investors with high risk tolerance and the ability to sustain potential total loss. The company’s success hinges on regulatory approvals, reimbursement decisions, clinical adoption, and ultimately achieving scale in its target markets. However, for investors seeking exposure to AI-driven medical diagnostics with substantial upside potential should commercialization succeed, Acarix offers that opportunity at a modest valuation.

Investment Considerations

The three featured companies illustrate the spectrum of opportunities available within European penny stocks. Deceuninck represents a turnaround play with improving profitability despite revenue headwinds, appealing to value investors seeking operationally improving businesses. Nurminen Logistics offers exposure to Nordic transportation infrastructure with strong returns on equity and attractive valuation metrics, suitable for those seeking moderate growth with reasonable financial stability. Acarix provides high-risk, high-reward exposure to medical technology innovation for aggressive growth investors.

Several themes emerge across the broader penny stock landscape. Financial health varies considerably, with ratings spanning from four to six stars among the top ten names. This dispersion underscores the importance of individual security analysis rather than blanket sector allocation. Geographic diversity provides multiple exposure options, from Scandinavian technology and logistics to Belgian industrials and Italian media.

Investors considering penny stocks should maintain realistic expectations and appropriate position sizing. These securities typically exhibit higher volatility, lower liquidity, and greater business risk than large-cap alternatives. However, they also offer potential for substantial returns through operational improvements, market recognition, or acquisition activity.

Conclusion

The European penny stock market in October 2025 presents a diverse array of opportunities across geographies, sectors, and risk profiles. While the STOXX Europe 600 Index provides stability at the headline level, smaller companies continue to offer value creation potential for investors willing to conduct thorough due diligence and accept higher risk.

Deceuninck’s operational turnaround, Nurminen’s strong return metrics, and Acarix’s innovative medical technology each represent distinct investment theses within the penny stock category. Success in this market segment requires patience, analytical rigor, and appropriate risk management through diversification and position sizing.

As interest rate policies evolve and trade dynamics continue to shift, smaller companies may benefit from improved access to capital and increased investor risk appetite. Alternatively, economic headwinds could disproportionately impact less-established firms with limited financial buffers. Investors should monitor both company-specific developments and broader macroeconomic trends when evaluating these opportunities.

The penny stock market remains an often-overlooked segment where solid financial analysis and growth-oriented thinking can uncover compelling investment opportunities beyond the mainstream alternatives that dominate institutional portfolios.

This paper is for informational purposes only and does not constitute investment advice. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.