Swiss GPS and Smartwatch Maker Demonstrates Rising Market Leadership with Strong Fundamentals

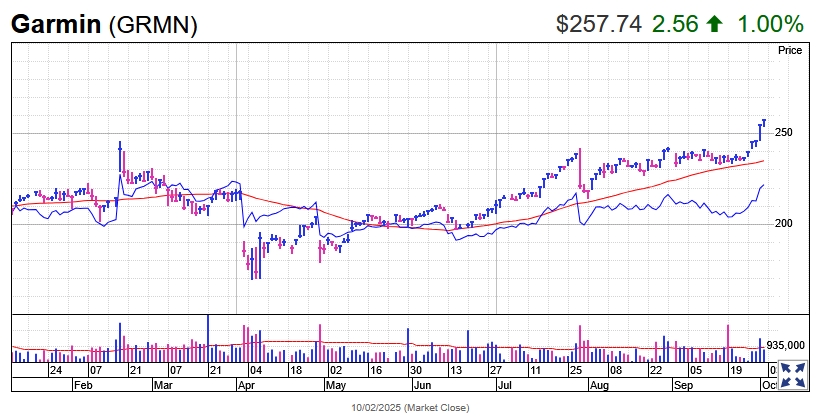

Garmin (GRMN) reached a record high on Thursday, cementing its position as the top-ranked company in the consumer electronics sector while delivering impressive profit and sales growth that has caught the attention of institutional investors.

The Switzerland-based manufacturer of GPS tracking devices, smartwatches, and health and fitness trackers saw its Relative Strength Rating jump from 80 to 83, crossing a critical threshold that historically signals major price appreciation potential. Market research shows that the biggest stock market winners typically sport an RS Rating above 80 before launching their most significant price moves.

Elite Performance Metrics

Garmin’s upgraded RS Rating places it in the top 17% of all stocks for price appreciation over the past year. But that’s just one part of an impressive ratings profile. The company boasts a 90 EPS Rating out of a possible 99, indicating exceptional earnings performance relative to peers.

Perhaps most striking is Garmin’s 96 Composite Rating, which evaluates stocks on a 1-to-99 scale across seven key attributes of winning stocks. This rating means Garmin ranks in the top 4% of all publicly traded companies, a remarkable achievement that reflects its well-rounded strength across multiple performance dimensions.

Institutional Support Building

The company has earned a B Accumulation/Distribution Rating, suggesting that sophisticated institutional investors—including university endowments and mutual funds—have been actively accumulating shares. This professional money flow often precedes sustained price appreciation.

Industry Leadership Position

Garmin holds the No. 1 position among its peers in the 18-stock Consumer Products-Electronics industry group, outpacing competitors like Sonos (SONO) and Zepp Health (ZEPP). The industry group itself ranks No. 33 out of 197 industries tracked by IBD, indicating sector-wide strength.

Strong Fundamental Performance

The company’s recent earnings report revealed robust growth acceleration. Third-quarter earnings surged 37% year-over-year to $2.17 per share, a dramatic improvement from the 13% growth rate in the previous quarter. Revenue growth also accelerated sharply, jumping from 11% to 20% to reach $1.814 billion.

This acceleration in both earnings and revenue growth represents the kind of fundamental strength that typically supports sustained stock price appreciation.

Technical Considerations

Garmin stock recently moved more than 5% past a 242.47 entry point in a first-stage cup-with-handle base, pushing it beyond the optimal buy zone that technical analysts typically monitor. Investors following IBD methodology will now watch for new buying opportunities, such as a three-weeks-tight pattern or a pullback to support levels at the 50-day or 10-week moving averages.

The company is scheduled to report its next quarterly results around October 29, which will provide investors another opportunity to assess whether the growth momentum can be sustained.

The Bottom Line

Garmin’s combination of accelerating fundamentals, strong institutional support, industry leadership, and improving technical strength positions it as a standout performer in today’s market. With its RS Rating now above the critical 80 threshold and a top-4% Composite Rating, the company exhibits the characteristics that historically precede major winning stocks.

For investors seeking market leaders with both fundamental and technical strength, Garmin’s current performance merits close attention. The key will be watching whether the company can maintain its growth trajectory when it reports earnings later this month.