As global markets navigate cautious monetary policies and shifting economic indicators, Asian penny stocks continue to offer compelling opportunities for investors willing to look beyond traditional large-cap investments. While these lower-priced securities may carry the reputation of being remnants from earlier market periods, they remain a viable investment avenue when backed by strong financial fundamentals and solid operational performance.

The key to success in this market segment lies in identifying companies that combine attractive valuations with robust financial health. By focusing on businesses with sound balance sheets and proven track records, investors can potentially uncover significant growth opportunities at accessible price points.

What Makes a Penny Stock Worth Watching?

The most promising penny stocks in Asia share several characteristics: strong financial health ratings, manageable debt levels, and the ability to generate consistent cash flows. Companies that demonstrate operational efficiency, strategic growth initiatives, and transparent management practices stand out in this space.

Current market conditions have created an environment where quality penny stocks are trading at attractive valuations, offering potential entry points for discerning investors. The following companies represent some of the most interesting opportunities across various Asian markets.

Top Performers in the Asian Penny Stock Space

The Asian penny stock universe currently includes several standout performers across different sectors and geographies. Companies like JBM (Healthcare), Lever Style, TK Group (Holdings), and T.A.C. Consumer have earned top financial health ratings of six stars, indicating exceptionally strong fundamentals. Meanwhile, Yangzijiang Shipbuilding (Holdings) demonstrates that even companies with larger market capitalizations (SGD 13.18 billion) can still be classified as penny stocks based on their share prices.

Other notable mentions include Food Moments from Thailand’s SET exchange, CNMC Goldmine Holdings listed on Singapore’s Catalist, and Ekarat Engineering, each bringing unique sector exposure and growth prospects to the table.

Featured Opportunities: Three Stocks to Consider

Mount Everest Gold Group

Mount Everest Gold Group has emerged as an intriguing play in the jewelry retail sector, demonstrating remarkable operational momentum. The company’s New Jewellery Retail segment posted impressive growth, with sales surging to CN¥236.33 million in the first half of 2025 from CN¥98.51 million in the same period last year. This substantial increase stems from favorable gold price movements and the company’s strategic use of low-cost inventory, which has significantly enhanced gross profit margins.

Perhaps most notably, Mount Everest Gold Group successfully transitioned from recording a net loss to achieving net income of CN¥75.25 million. This turnaround was supported by the strategic divestiture of its Fresh Food Retail segment, allowing management to focus on its core jewelry business. The company’s inclusion in the S&P Global BMI Index adds an additional layer of credibility and potential for increased institutional interest.

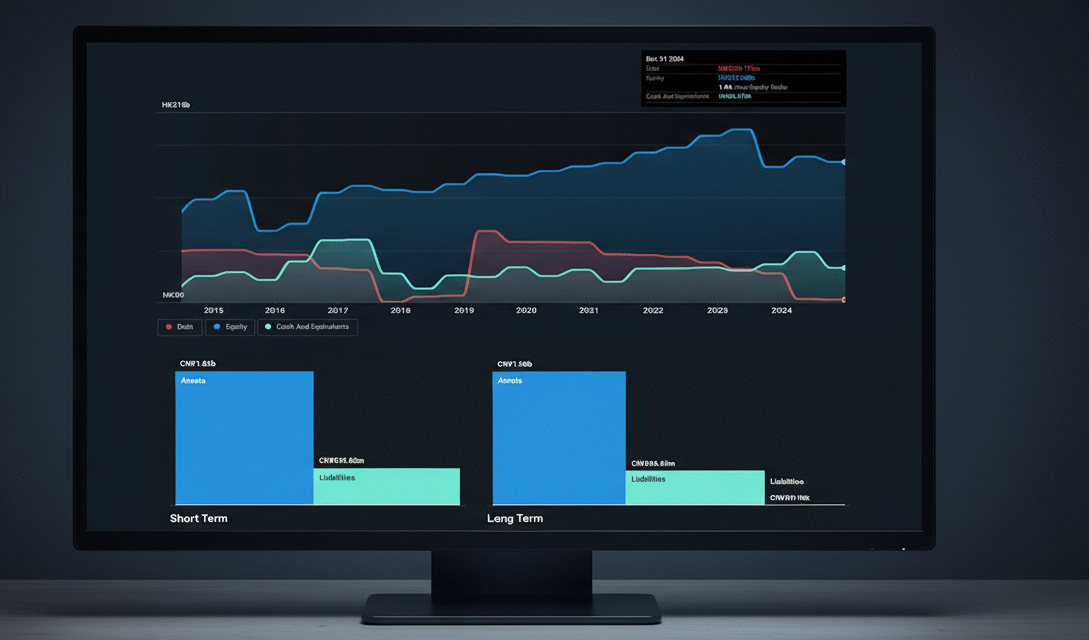

From a financial health perspective, the company maintains comfortable asset coverage for both short and long-term liabilities, providing a solid foundation for continued operations. While the return on equity remains modest at 2.5%, the strong improvement trajectory and five-star financial health rating make this stock worth monitoring.

United Energy Group

United Energy Group operates in the strategically important upstream oil, natural gas, and clean energy sectors across Pakistan, South Asia, the Middle East, and North Africa. With a market capitalization of HK$13.70 billion, the company has recently achieved profitability, reporting net income of HK$740.15 million for the first half of 2025.

The company’s production volumes have increased substantially, driven by effective operational management and new discoveries in its exploration activities. While sales experienced a slight decline to HK$8.09 billion, the company’s ability to generate robust operating cash flow that adequately covers its debt obligations demonstrates financial discipline and operational strength.

United Energy Group’s asset coverage of long-term liabilities remains strong, suggesting financial stability despite some volatility in earnings performance. Investors should note that the company has experienced some insider selling activity, which may warrant monitoring for signals about internal confidence levels. Additionally, the relatively new composition of the board and management team, with limited tenure experience, could influence strategic decision-making going forward. The current return on equity stands at 10.1%.

Pizu Group Holdings

Pizu Group Holdings operates in the specialized niche of civil explosives manufacturing, trading, and sales, with operations spanning the People’s Republic of China and Tajikistan. The company brings several attractive characteristics to the table, including a seasoned management team and board with average tenures of 5.6 and 6.8 years respectively.

The company has demonstrated impressive earnings growth of 24.7% over the past year, with management quality reflected in the high quality of those earnings. Current valuations appear particularly attractive, with the stock trading at a significant discount to its estimated fair value, potentially offering investors a margin of safety.

However, prospective investors should carefully consider certain risk factors. The company faces a challenging near-term balance sheet situation, with short-term liabilities exceeding assets by CN¥300 million. Additionally, the debt-to-equity ratio has increased from 30% to 41.5% over the past five years, indicating rising leverage levels that require monitoring.

On a more positive note, Pizu maintains satisfactory net debt levels relative to equity at 8.7%, and its operating cash flow covers debt obligations at a healthy 57% ratio. The company recently increased its dividend, signaling management’s confidence in future cash generation and commitment to returning value to shareholders. Weekly price volatility remains stable at around 7%.

Investment Considerations

When evaluating Asian penny stocks, investors should adopt a comprehensive approach that extends beyond simple share price metrics. Financial health ratings serve as useful starting points, but understanding the underlying business fundamentals, management quality, debt levels, and cash flow generation capabilities provides crucial context for investment decisions.

The current market environment, characterized by cautious central bank policies and fluctuating global indices, requires investors to be particularly selective. Companies that demonstrate resilience through strong balance sheets, proven management teams, and clear growth strategies are better positioned to navigate economic uncertainties.

Diversification remains essential when investing in penny stocks, as these securities can exhibit higher volatility compared to larger-cap alternatives. Investors should consider position sizing carefully and maintain appropriate risk management practices.

Conclusion

The Asian penny stock market continues to offer opportunities for investors willing to conduct thorough research and maintain a disciplined investment approach. Companies like Mount Everest Gold Group, United Energy Group, and Pizu Group Holdings exemplify different facets of this market segment, each presenting unique value propositions alongside specific risk considerations.

As we progress through October 2025, monitoring these stocks and the broader list of financially sound penny stocks across Asian exchanges could reveal compelling entry points. Success in this space requires patience, diligent analysis, and a focus on companies that combine attractive valuations with solid fundamental characteristics. By maintaining these principles, investors can potentially benefit from the growth opportunities that Asian penny stocks continue to present.