The UK market has encountered headwinds in recent months, with the FTSE 100 index declining amid weak Chinese trade data and broader global economic uncertainties. For investors navigating these turbulent waters, dividend stocks can provide a valuable combination of income generation and portfolio stability during periods of market volatility.

The Case for Dividend Stocks in Uncertain Times

When market indices fluctuate and growth stocks face pressure, dividend-paying companies offer investors a cushion through regular income payments. These stocks can help offset capital losses and provide cash flow that investors can either reinvest or use for living expenses, making them particularly attractive in challenging economic environments.

Three Dividend Opportunities Worth Considering

From a comprehensive analysis of UK dividend stocks, three companies stand out for their strong dividend coverage and compelling valuations. While none offer yields at the very top of the UK market, each presents interesting characteristics that merit consideration.

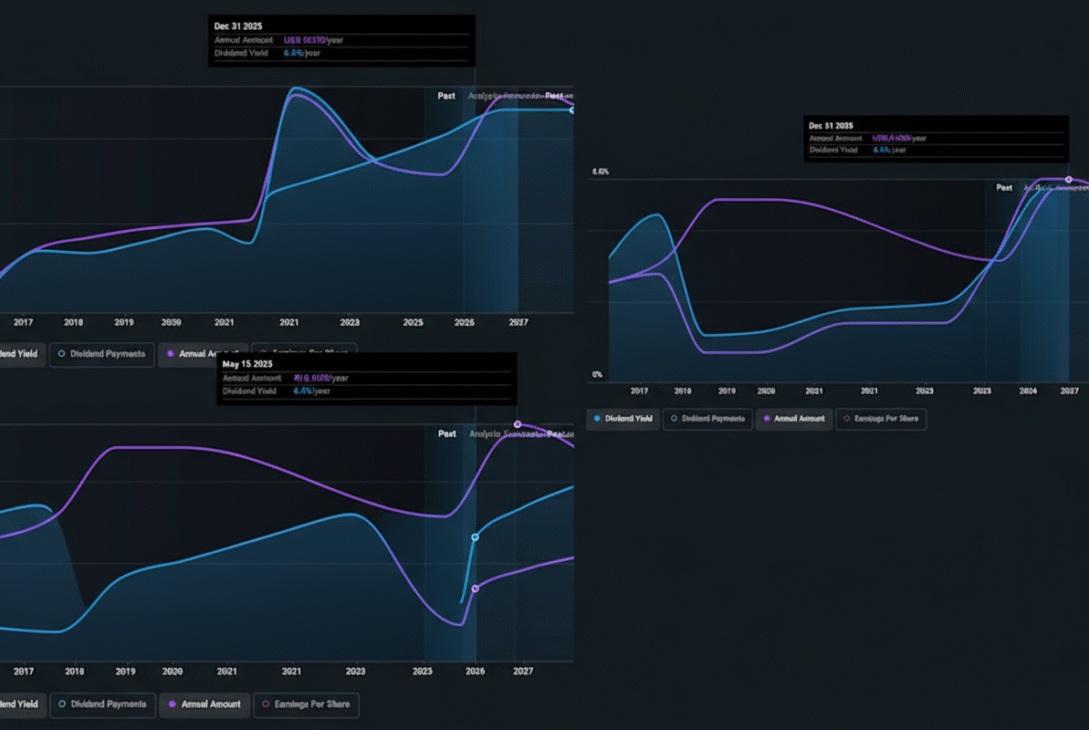

1. Helios Underwriting (Dividend Yield: 4.4%)

Helios Underwriting provides shareholders with a limited liability investment opportunity in the prestigious Lloyd’s insurance market. With a market capitalization of £161.68 million, this specialized investment vehicle has demonstrated meaningful financial improvement.

The company’s net income rose to £4.41 million for the half-year ended June 30, 2025, signaling strengthening operational performance. What makes Helios particularly attractive from an income perspective is its conservative payout approach. The company’s dividends are well supported by both earnings and cash flows, with payout ratios of 29.8% and 31.8% respectively. This conservative distribution policy leaves substantial room for dividend sustainability even if business conditions deteriorate.

While Helios has experienced dividend volatility historically, the recent appointment of Louis Tucker as CEO could provide the strategic leadership needed to stabilize and potentially grow distributions over time.

2. Multitude AG (Dividend Yield: 3.4%)

Operating in Finland’s digital financial services sector, Multitude AG offers lending and online banking services across three distinct segments: SME Banking, Consumer Banking, and Wholesale Banking. With a market cap of €152.78 million, this fintech company has shown impressive recent momentum.

The company reported substantial earnings growth in the first half of 2025, with net income reaching €14.16 million. Like Helios, Multitude maintains highly conservative payout ratios of just 23.5% for earnings and a remarkably low 5.1% for cash flows. This means the company distributes only a small fraction of its profits and cash generation, providing an exceptional margin of safety for dividend payments.

Although Multitude’s dividend history has been volatile over the past decade, recent earnings momentum suggests the company may be entering a more stable phase. Additionally, the stock trades at a discount to its estimated fair value, potentially offering capital appreciation alongside income.

3. Integrated Diagnostics Holdings (Dividend Yield: 3.1%)

Integrated Diagnostics Holdings operates in the healthcare sector, providing medical diagnostics services to patients across its markets. With a market capitalization of $316.82 million, the company has demonstrated strong operational growth despite challenging market conditions.

Revenue reached EGP 3.54 billion for the first half of 2025, reflecting robust demand for the company’s diagnostic services. The company’s dividends are well protected by earnings with a 46% payout ratio and by cash flows at 40.8%, indicating sustainable distribution levels.

While Integrated Diagnostics has experienced both share price volatility and an unstable dividend history, the company’s strong revenue growth trajectory and significant trading discount to estimated fair value present an intriguing risk-reward proposition for income-focused investors willing to accept some uncertainty.

The Bottom Line

These three dividend stocks offer yields ranging from 3.1% to 4.4%, which, while below the highest-yielding UK stocks, come with the advantage of well-covered distributions and reasonable payout ratios. This conservative approach to dividend payments suggests these companies prioritize sustainability over headline-grabbing yields.

For investors seeking to enhance their portfolios with income-generating investments during uncertain times, companies like Helios Underwriting, Multitude AG, and Integrated Diagnostics Holdings demonstrate that attractive dividends need not come at the expense of financial prudence. Their combination of reasonable yields, strong dividend coverage, and in some cases compelling valuations, makes them worthy of further research for those building resilient, income-focused portfolios in today’s challenging market environment.